How to Incorporate a Private Limited Company in Singapore

Singapore is one of the most business-friendly jurisdictions in the world, with low tax rates, strong legal protections, and fast incorporation processes. If you’re planning to set up a company in Singapore, a private limited company is the most common and flexible structure.

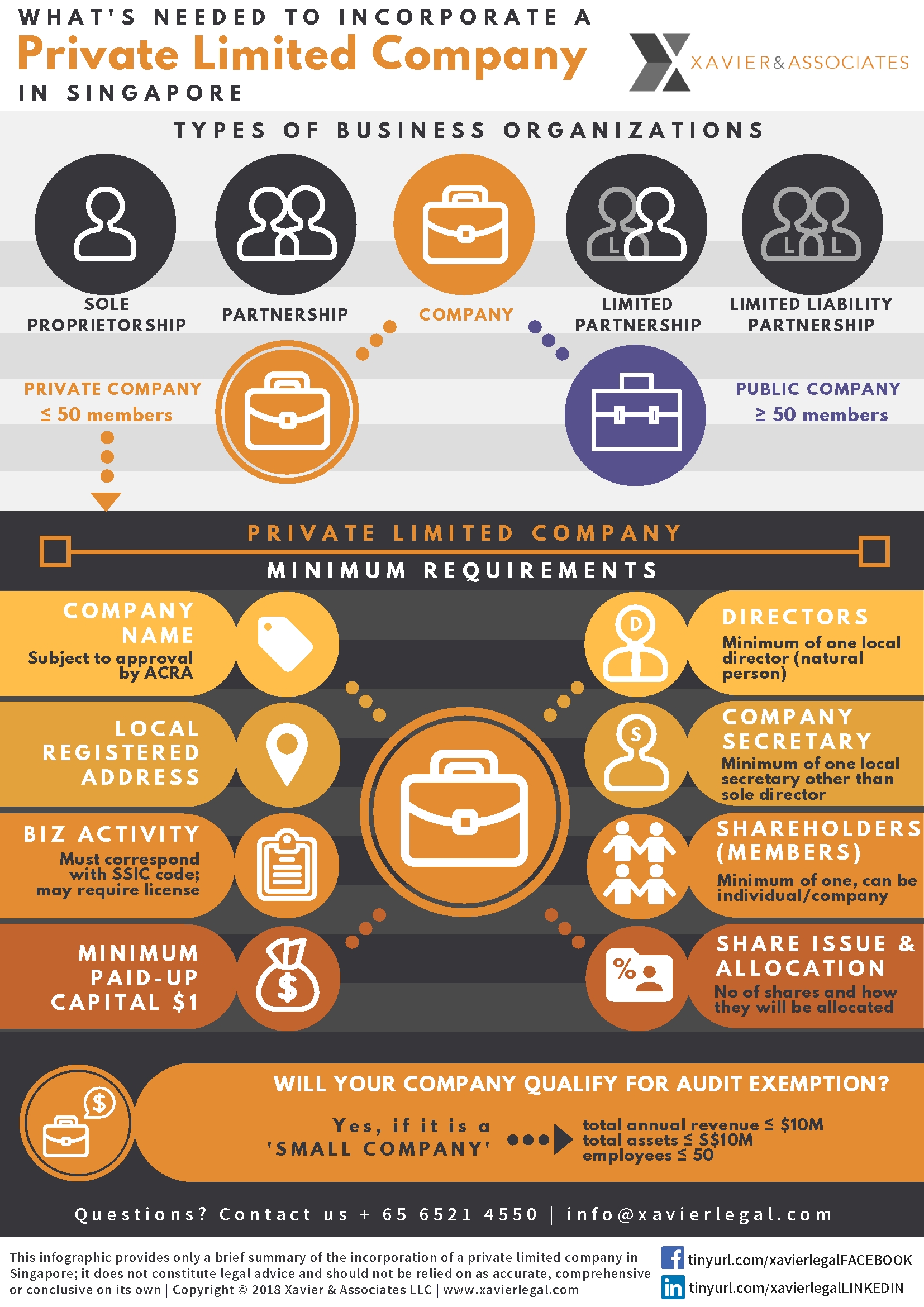

Why Choose a Private Limited Company?

Private limited companies offer limited liability protection, ease of transferability, credibility with investors, and eligibility for tax incentives. They are distinct legal entities from their shareholders and directors.

Minimum Requirements

- At least one local director (natural person)

- At least one shareholder (can be individual or company)

- A Singapore-registered company address

- Appointed company secretary (cannot be sole director)

- Minimum paid-up capital of S$1

- Approval of company name by ACRA

- Business activity code (SSIC code) and any required licences

Audit Exemption Criteria

Your company may qualify for audit exemption if it is considered a “small company” under Singapore law. This typically means:

- Total annual revenue ≤ S$10 million

- Total assets ≤ S$10 million

- Employees ≤ 50

Get Started with Xavier & Associates LLC

Thinking of incorporating a company in Singapore? Contact us for a no-obligation discussion. We help businesses from all over the world take their first step here, and help them succeed as they grow.

Frequently Asked Questions

What’s the difference between a private limited company and a sole proprietorship?

A private limited company is a separate legal entity offering limited liability. A sole proprietorship is not distinct from its owner and carries unlimited liability.

Can foreigners incorporate a private limited company in Singapore?

Yes, foreigners can incorporate a Singapore company but must appoint at least one local director who is ordinarily resident in Singapore.

What is the cost of incorporating a company in Singapore?

Basic incorporation typically starts from S$315 in ACRA fees. Additional costs may apply for corporate secretarial services, nominee directors, and address services.